Mr. Jaime A. Kaneshina, CLFP, BPB, is the Director of Finance and has been active in the commercial equipment and titled vehicle finance industry since 1988. He earned the prestigious Certified Leasing Professional (CLFP) in 1999 and Best Practices Broker in 2009 designations becoming only one of seven individuals in the United States to have been awarded BOTH certifications (as of October 1, 2025).

PROVIDING TRUST AND TRANSPARENCY FOR OVER 30 YEARS

The Cambridge Capital Group appreciates the opportunity not only to earn your business today but in the future.

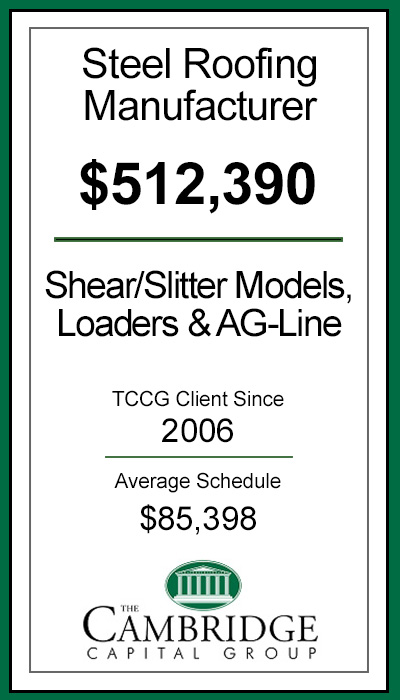

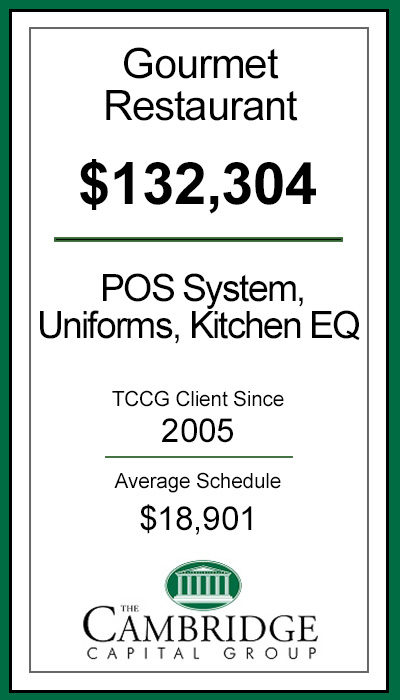

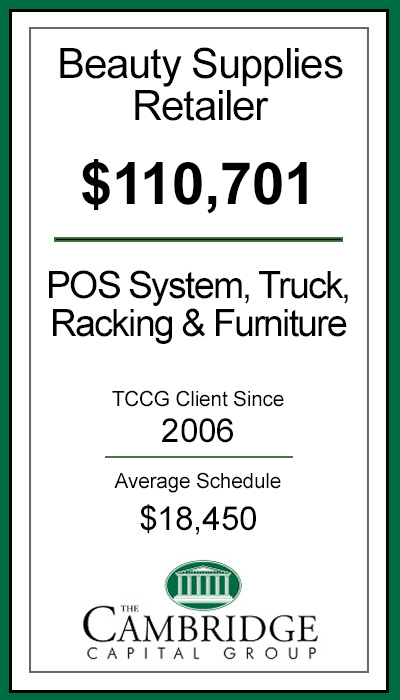

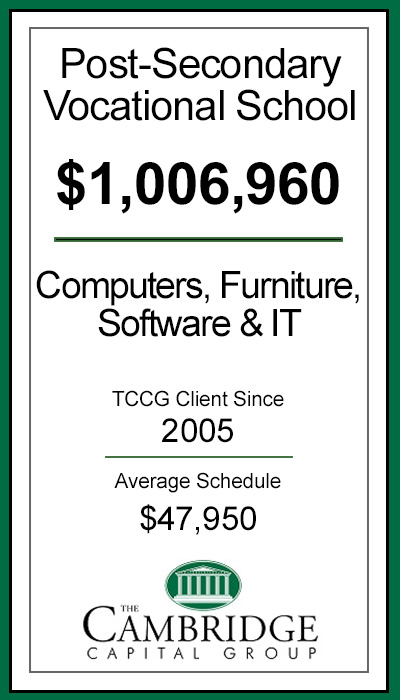

We pride ourselves in cultivating and incorporating this long-term philosophy when establishing a relationship with a prospective client. Over 90% of our clients are repeat clients; averaging 9 schedules spanning 6.4 years per repeat client across almost every industry in the U.S.

Our loans are made or arranged pursuant to a California Financing Law license.

WHO WE ARE

The Cambridge Capital Group is a national, full service, licensed commercial finance company that provides funding for business essential equipment and commercial titled vehicles. Through our funding conduits, we finance a wide range of equipment from $10,000 to $10,000,000 in numerous industries.

The Cambridge Capital Group is headquartered in the Exchange Professional Center in Rancho Cucamonga, California. Our friendly and professional staff is committed to providing finance solutions to satisfy your current and future capital requirements.

WHO WE ARE NOT

At The Cambridge Capital Group, we are aware of various sales techniques utilized by some of our competitors in order to unethically increase the profitability of a transaction and we do NOT condone such tactics NOR do we employ their use.

We do NOT utilize interim rent as an additional profit center.

INTERIM RENT

Interim rent is a charge for a partial monthly, quarterly, semi-annual, or annual payment which is EXCLUSIVE of the number of payments required in the transaction’s originally documented term.

For example: If a transaction commences on the 12th of March whereby the terms are 36 monthly payments of $1,000.00, the client will be assessed a partial payment for the nineteen (19) remaining days of March resulting in a $612.90 charge. The client’s monthly payment was based upon the original cost of the equipment to be recovered over the 36 month term. Therefore, this additional partial payment is pure profit as it does not reduce your obligation under the original Agreement.

We do NOT misrepresent how advance monies will be applied.

ADVANCE PAYMENTS

When a transaction is documented, traditionally finance companies require the remittance of advance payments. Although this is to evoke “consideration” for their entering into the transaction, one should pay special attention to how these monies are applied.

For example: A client receives a quotation for a 36 month term. The finance company indicates that the monthly payment will be $900.00 with the first and last payment required in advance. However, when the final documentation arrives, the term is actually 38 months. Therefore, the finance company did not apply the first and last month’s payments previously quoted, as 36 payments remain instead of 34. The finance company “earns” an additional $1,800.00 via misrepresentation.

We CLEARLY disclose how the sales tax will be collected in our documentation.

DOUBLE TAXATION

Often a leasing company will quote a monthly payment which does NOT account for sales tax.

For example: A client requests a quotation based upon a total of $70,037.50 inclusive of sales tax. This represents an equipment cost of $65,000.00 plus applicable sales tax of 7.75% or $5,037.50. Upon signing the documentation, a client may not notice the verbiage “plus applicable sales tax” or a box checked indicating that sales tax is billed monthly. When the payment booklet arrives, the client realizes the total payment is higher than what was expected due to the presence of tax added to the payment originally quoted. The lease payment is based upon $70,037.50, and then tax is added to this amount. Effectively the lender keeps an additional 7.75% profit from the double taxation scheme.

We do NOT require a blanket lien on your company's assets for approval. Only the equipment or titled vehicle being financed is our sole collateral.

BLANKET LIEN

A blanket lien is an encumbrance whereby a portion if not all of the company’s assets are pledged as additional collateral. Blanket liens are traditionally utilized within the banking industry, most notably with a line of credit. Some finance companies secure an approval by structuring a transaction with a blanket lien, however, do not disclose this additional credit enhancement.

For example: Should a company default on an obligation, a financial institution with a blanket lien has the legal right to commence liquidation of inventory, account receivables, and fixed assets. Needless to say, its presence hinders a client’s ability to secure additional financing.

We do NOT utilize Commitment Deposits to leverage clients.

COMMITMENT DEPOSITS

Although not all Commitment Deposits are utilized for unethical purposes, it is prudent to be wary of committing to a Proposal where monies are requested up-front. Clients often misunderstand the difference between a Proposal and an actual approval.

For example: A finance company remits a proposal with a “very low” monthly payment and request a Commitment Deposit. Based upon the proposed payment, the client remits a deposit in “good faith”. When the documentation arrives, the payment is often higher than the previously agreed upon amount in the original Proposal. When the client contacts the finance company and refuses to accept the “new” payment, the deposit is used as leverage to get the client to proceed with the transaction and its “new” payment.

We ALWAYS provide clients with a separate document clearly stating the pre-negotiated residual position agreed to by all parties prior to the transaction’s documentation.

FAIR MARKET VALUE LEASES

Upon maturity of a Fair Market Value (FMV) Equipment Lease Agreement, the Lessee has the options to: 1) Pay the finance company an amount equal to the fair market value of the equipment, or 2) Return all equipment covered under the Lease, or 3) Continue remitting payments for a pre-negotiated period of time. Clients prefer this type of option due to its accounting and income tax benefits, however, in many instances a customer may be misled into believing a Lease has a One Dollar ($1.00) Buy-Out option.

For example: After the lease is signed, a lessee may later realize a purchase option document was never provided. The customer has actually entered into a FMV lease. Any verbal mention of a $1 buyout by a leasing company salesperson may not then be enforced. This unethical tactic could end up costing a company thousands of dollars if the lessee, for whatever reason, is unable or unwilling to box up the original equipment and return it to the lender.

We DO NOT have an extension clause in our Equipment Lease Agreement NOR in supporting documentation. One Dollar ($1.00) purchase options are NEVER extended.

EXTENSION CLAUSE

This clause is within the verbiage of an Equipment Lease Agreement whereby a transaction will automatically extend an additional number of payments if the Lessee does not provide adequate notification of their intention to exercise their purchase option within the “buy-out” provision.

For example: A company enters into a lease agreement with a $1 buy-out. The documentation states lessee must give 180 days notice of the intention to purchase the equipment for One Dollar. If written notice is forgotten by lessee, or given late, the lease is extended for an additional six to twelve months! Although this sounds absurd, this practice is legally enforceable if not noticed during signing of the documentation.

WHY CHOOSE US

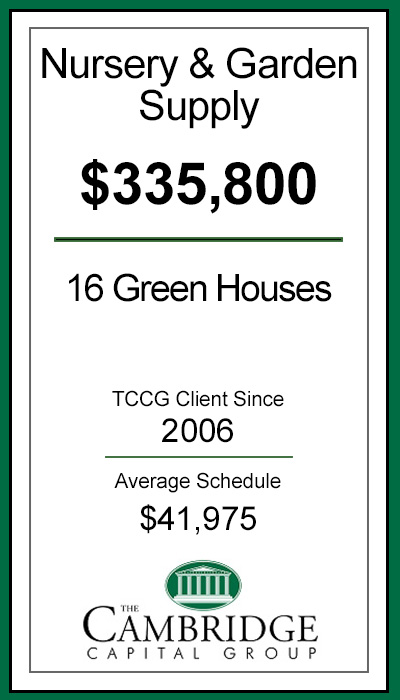

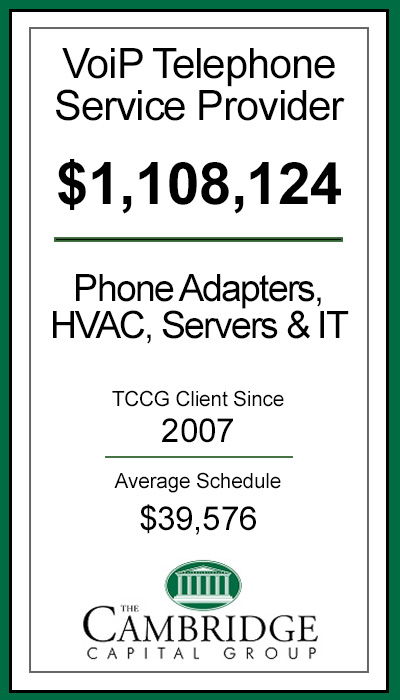

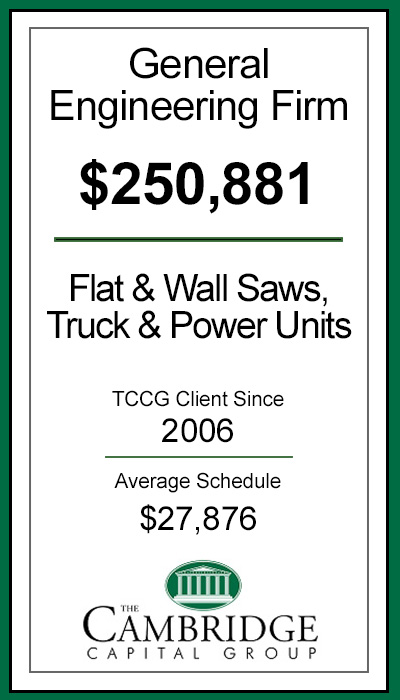

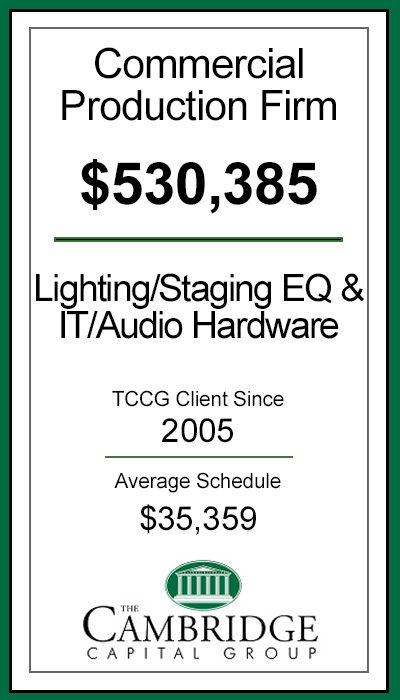

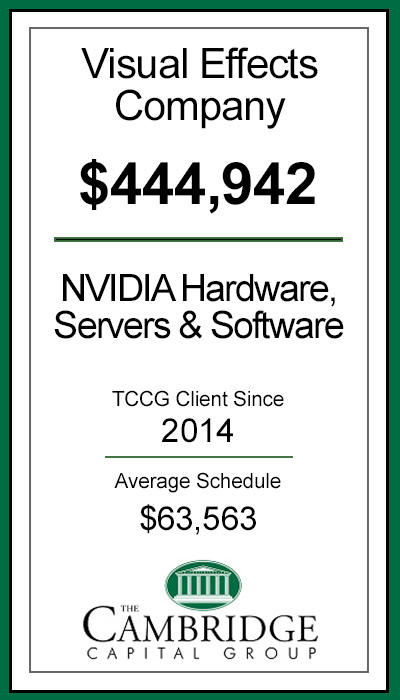

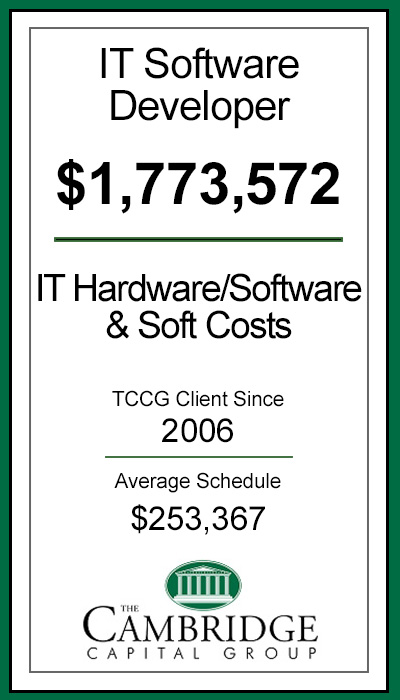

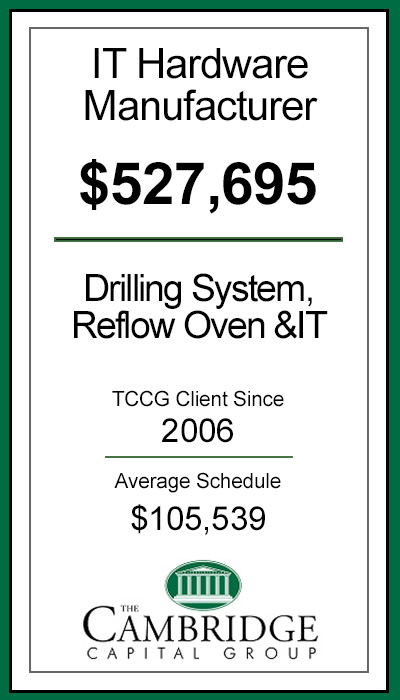

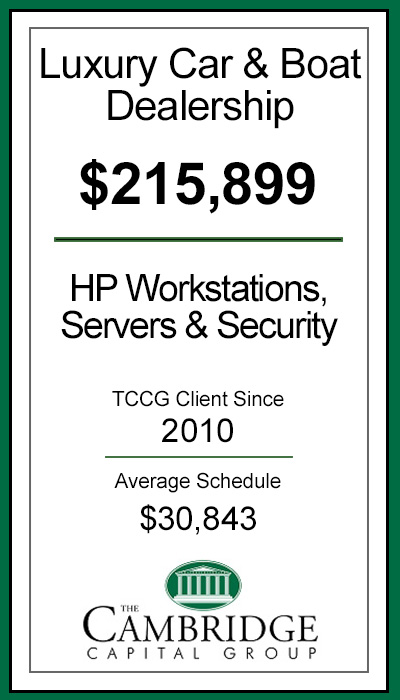

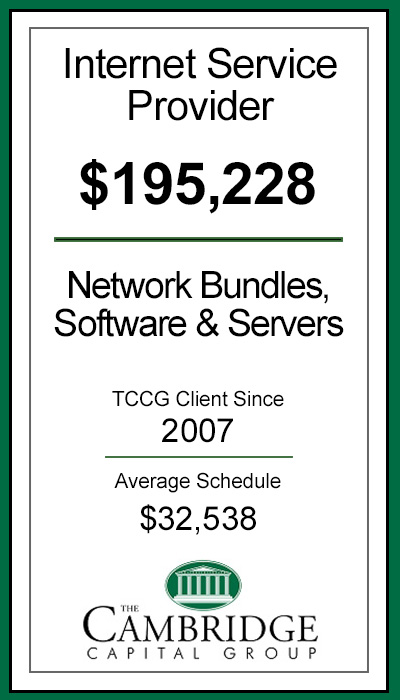

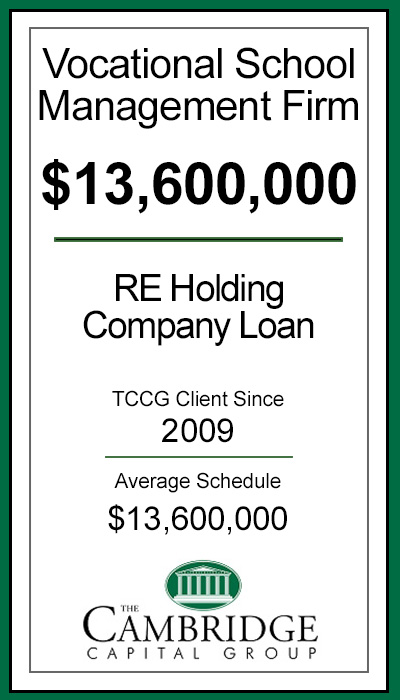

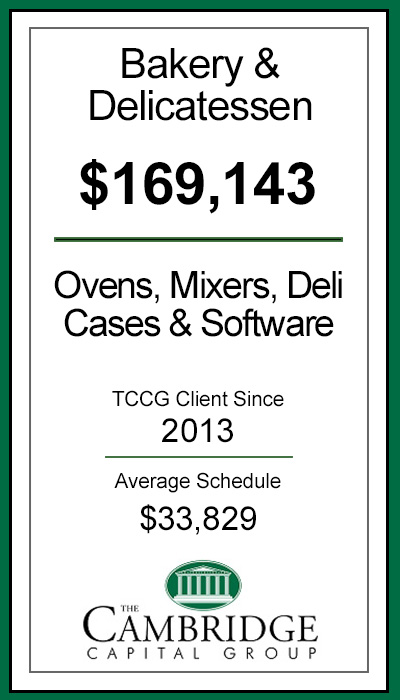

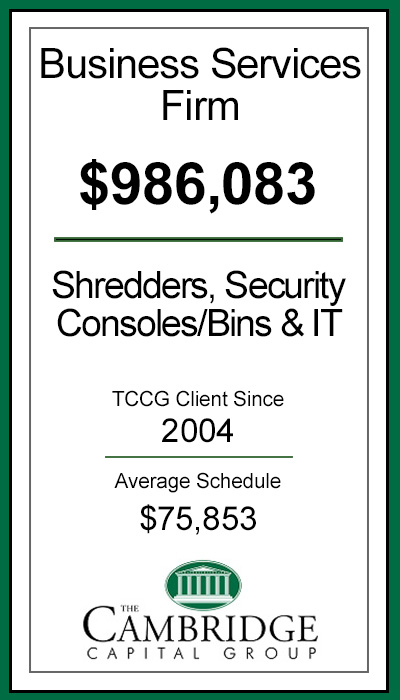

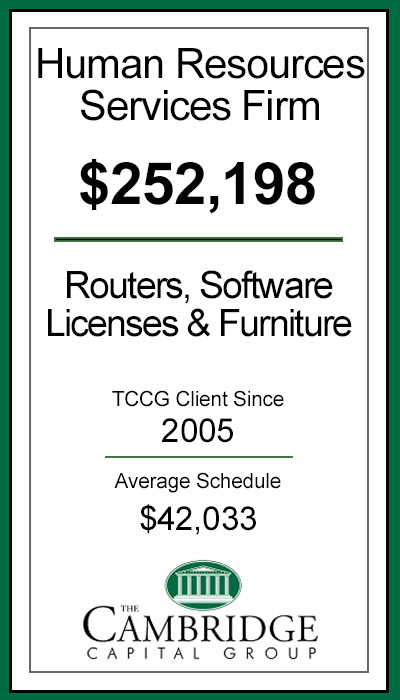

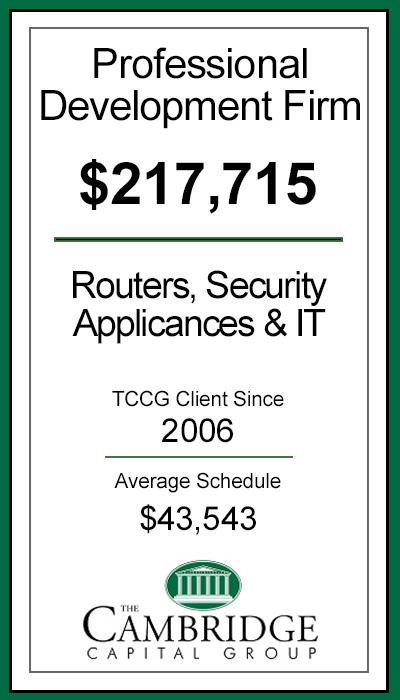

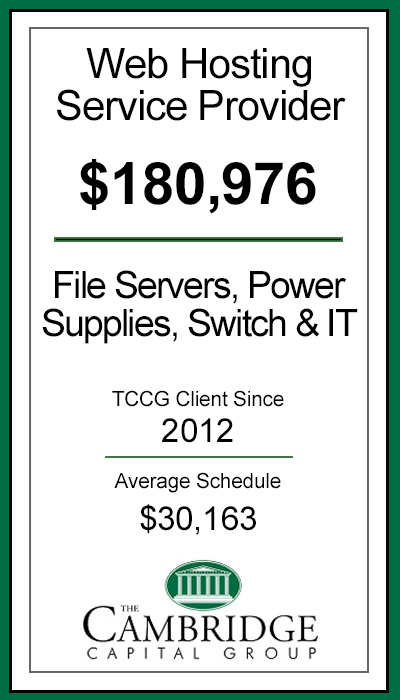

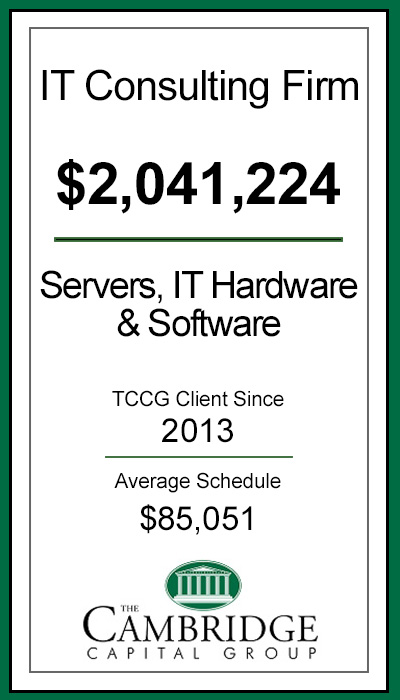

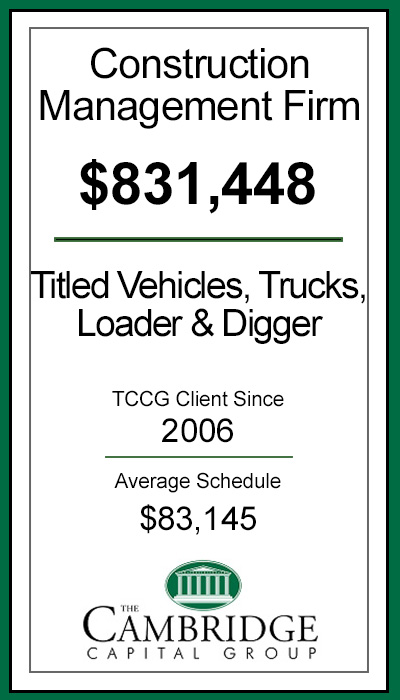

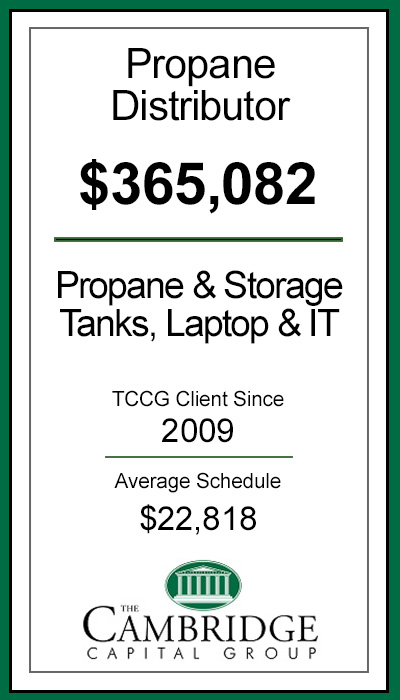

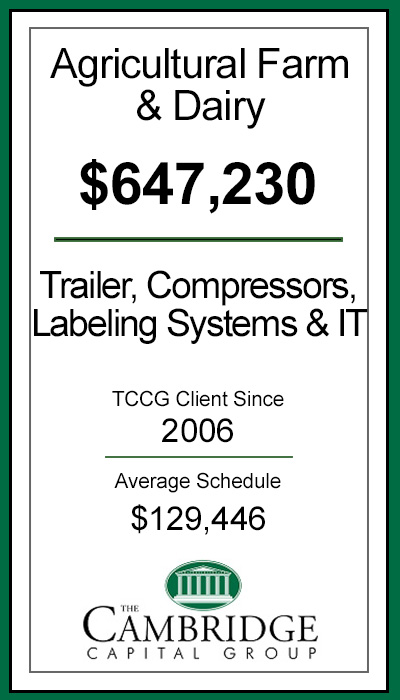

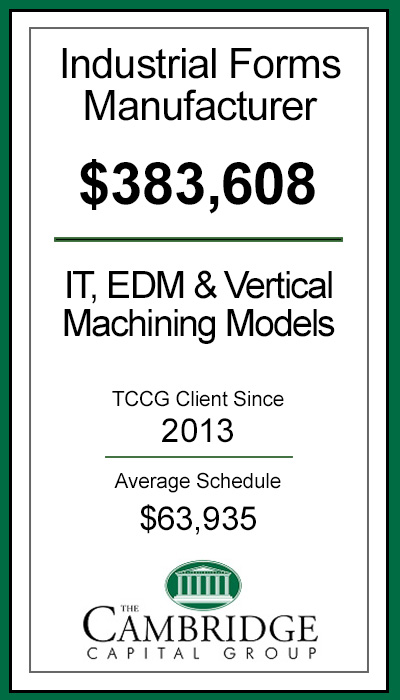

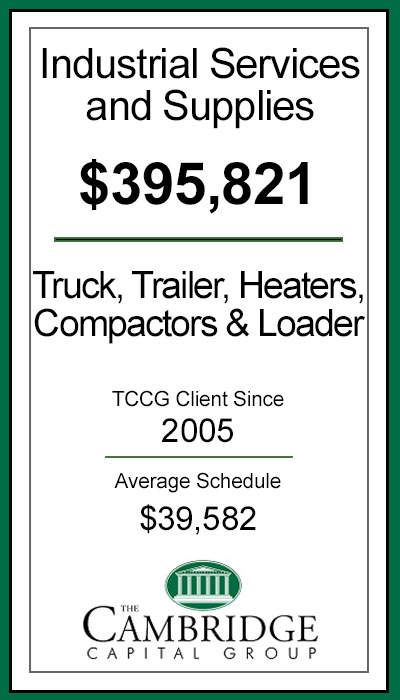

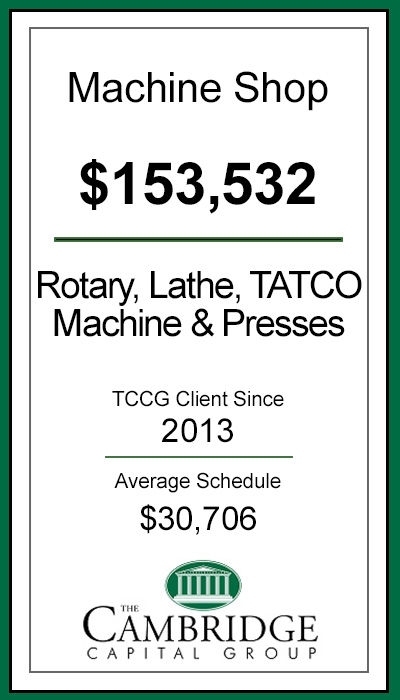

CLIENTS WE'VE SERVED

Over 92.95% of our clients are repeat clients; averaging 9 schedules spanning 6.4 years per repeat client across almost every industry in the U.S.

OUR SERVICES

CONTACT US

TCCG, LLC dba The Cambridge Capital Group

Exchange Professional Center

7365 Carnelian Street, Suite 228

Rancho Cucamonga, CA 91730-1136

Toll Free: 866.688.TCCG (8224)

Main: 909.606.0662

Fax: 909.606.1399

Email: info@theccgrp.com